The Phenomenal Financial Blast

Let's get REAL About the Money!

8 Part On-Demand Course with Ellen Rohr (Replay the First Session Below)

Dear Friend and Fellow Business Owner,

On a regular basis, I commit to practicing “rigorous honesty” with my team.

My hubby, Hotrod, and I tell each other the truth, and confront our financial situation formally, by reviewing the reports, and meeting with our “Bean Team.” Gone are the days where I was in denial (and, let’s face it – lying!) about my financial position. AND IT FEELS SOOOO MUCH BETTER to tell the truth!

Are you in denial about the money?

Are you convinced that you’re not not lying because you don’t really know what the situation is?

Gulp.

Is it time for you to get real about your financial situation?

Sometimes it helps to start the conversation with a safe person and in a safe place.

That’s why I taught a Webinar Series – The Phenomenal Financial Blast – Let’s Get Real About the Money! (My friend, Howard Partridge and his phenomenal team has hosted for us!)

This 8 Part Training Series is recorded and available for unlimited replays for up to a year.

The content is delivered immediately by email once you join in.

I want to help YOU plan for your best year ever!

Introducing...

The Phenomenal Financial Blast

8 Part Webinar Series with Ellen Rohr

Here's an Outline of Everything Discussed Throughout the Series...

Session 1 – Replay the First Session at No Charge

What do you REALLY need to know about the money? On this Introductory Webinar – Ellen lays out the simple plan for becoming a financial powerhouse...and laying claim to your responsibilities. (Hey, it's your money!)

Session 2 – Getting to KFP

Ellen shares the standard systems, the essential reports and procedures for you and your "Bean Counting Team." Even if it's just you, for now.

Session 3 – The B Word, Budgeting

This is where we establish goals and a reasonable selling price. So good!

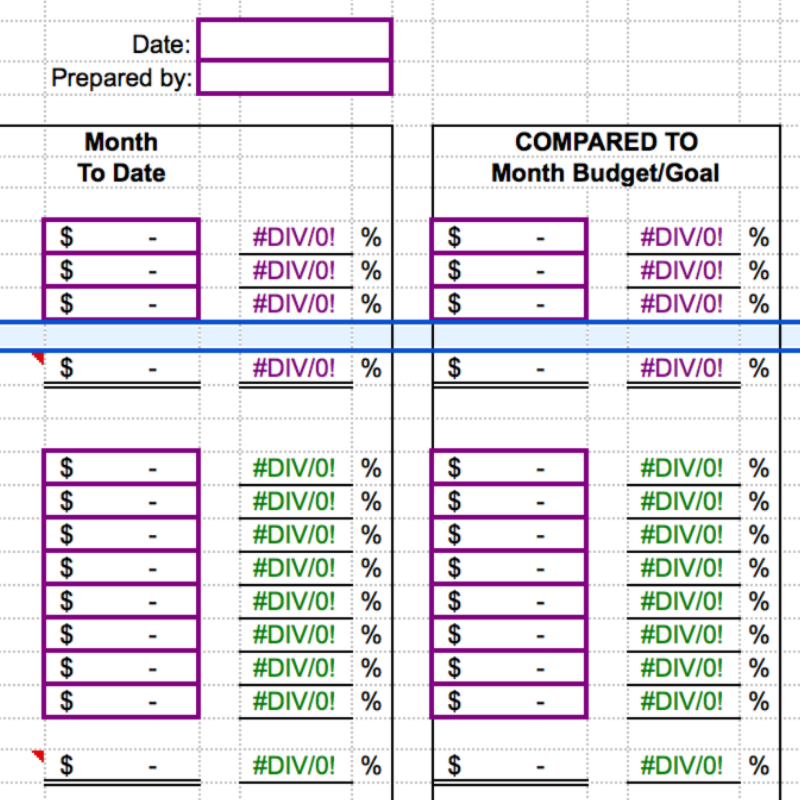

Session 4 – The FQC - or, How to Make Money Every Month!

This is a great way to keep score and make more $. When to expand, and when to cut back? This report helps you make better decisions. One of my clients said, "Once I started to use the Financial Quick Check, I haven't lost money in a month since." How cool is that?

Session 5 – Raising Your Prices, and Reducing Your Fear

If you are going to charge more, you have to be more. Which is ridiculously easy to do. This will be a fun, creative, lively session.

Session 6 – Finding the Sweet Spot

Let's figure out which customers and clients are the best fit for you. Smooth sailing jobs with mega-profitability. The score will light the way.

Session 7 – Getting Your Team In On the Game

What if they knew the score? I've discovered your team will fix everything for you! I'll introduce Open Book Management and how to use it to play a really big game.

Session 8 – What Few Things Make the Difference

In this last session, we review and share commitments. What will you do that will change everything. One focused action, one or two engaged projects...you could create a positive quantum shift in your business, and your life!

Unlock the POWER of Financial Management! It’s YOUR money. Learn where it is, where it goes…and how to make more of it! Let's make Business UN-complicated!

Here's what is included with the entire program...

Eight Training Webinars - you'll learn a step by step system on how to reward your team the right way... it's a win, win!

Unlimited Replays on all sessions for 1 Year!

Access to a support along the way - ask questions, join in on conversation, and connect with a community of business owners who are growing, just like you

Access to forms, checklists and scorecards so you don't have to reinvent the wheel.

Access to the previous course recorded so you can work ahead and for your questions along the way

AND lots of love and care from Ellen Rohr - you'll get the opportunity to learn directly from them. E-mail them directly too.

About Ellen Rohr

From The Plumber’s Wife to America’s Top Expert on Making Big Money Doing Dirty Jobs!

Once upon a time, I almost sank our family business. I assumed I knew enough about business to run a dinky little plumbing company. After all, I had spent about $100,000 of my parents’ money on my college degree in Business Administration. In fact, I graduated at the top of my class. Still, I didn’t know how to balance a checkbook!

I got involved in my husband’s company after his partner died unexpectedly. Boy was I humbled! It seemed like lots of money was moving through the company, but at the end of the month there was never any money left. Thankfully, I found terrific mentors, savvy contractors who taught me how to keep score in business, how to put a simple business plan together, how to make money.

What I learned? How to make Business UN-Complicated. The key is to focus on the few things that have the biggest impact on your results. Business is EASY.

I started Bare Bones Biz, a venture capital and consulting company in 1995 to help folks of all ages turn their big ideas into successful businesses. I write as a columnist for Huffington Post, PHC News, business journals, and trade magazines around the country – providing “in the trenches” insight that business owners can relate to.

As president of Benjamin Franklin, The Punctual Plumber, a home service company, I helped grow the company from zero to $40 million in franchise sales and 47 locations in less than 2 years. I am also the President of Zoom Drain and Sewer, LLC, a new franchise company expanding in the North East USA. We make Business UN-Complicated so you can live Life UN-Leashed!

©2020. All rights reserved

NOTICE: Anytime money moves from or to someone, into or out of your company, there are requirements with which you must comply. Be sure to review with your CPA and financial planner how you, as the owner, put money in and take money out. Be sure check with your tax accountant and labor law professional or an attorney to make sure that the way you pay meets all compliance requirements. Salary, hourly pay, bonuses, and benefits all have tax requirements. You are responsible for this! Make sure you are up to speed with all state and federal income, payroll and all other tax laws.